MCN leaders provide investment fund updates and industry assessment at annual Fall Fund Update event

September 14, 2023

2023 has been anything but a typical year in the venture capital and angel investing industry. After two years of remarkable VC activity, the first eight months of this year have seen investing and exits slow to a crawl – in part driven by global events including a sharp increase in U.S. interest rates and global geopolitical disruptions. But to MCN CEO and Managing Director, Paul D’Amato is optimistic we will see market trends rebound in the coming months.

Mr. D’Amato presented his assessment on the VC market at this year’s annual MCN Fall Fund Update on September 13, held at the Frederik Meijer Gardens and Sculpture Park. The event, sponsored by Warner, Norcross and Judd, Northern Trust, and Michigan Capital Network Association attracted both investors and entrepreneurs from all around the state. The dinner presentation included comments from Grand Rapids Mayor Rosalynn Bliss, brief updates from 13 MCN portfolio company CEOs, an acknowledgement of MCN’s 20years of existence, and a CEO roundtable discussion which provided insight on current and future economic forces for early stage companies.

The afternoon featured a series of investment fund updates and educational breakout sessions, followed by a networking reception where new relationships were built and long-time friends reconnected.

Connecting is what MCN does best. The organization is a connector between entrepreneurs and member-investors. It carefully conducts due diligence on entrepreneurs and their innovations, and connects them with interested investors.

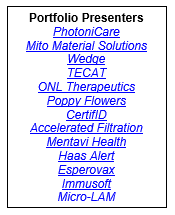

During the dinner presentation, leaders from more than a dozen of the MCN portfolio companies provided brief updates to the audience. From innovative healthcare firms to software solutions to precision technology, the executives updated the audience on their product development and business progress.

“This is the second year we have done the two-minute update format for our portfolio companies,” said Meagan Malm, Principal at MCN.

“We consider this a great way for our members to hear directly from the CEOs about how the companies are moving forward and what investors can expect in the coming months.”

Paul D’Amato took a few minutes after the main course to remind the audience of the history and impact of MCN. As Mr. D’Amato explained, the foundation for the organization was cast by several Grand Rapids area business leaders back in 2003 with the establishment of Grand Angels. Several months later, Jody Vanderwel was named president of Grand Angels, setting in motion a 20 year journey of investment and innovation success, some of which has changed our world for the better.

Meagan Malm took a moment to acknowledge the organization’s growing team including two new Principals, Abid Ali and Sapna Patel, Senior Analyst, Jenni Li, Accountant and Systems Manager, Elly Zandee, and Association Operations Manager, Susanna Stark. Their appointments have helped MCN strengthen its service to member-investors, and assist portfolio CEOs on their growth journey.

“MCN has grown to more than 30 active portfolio companies and those companies need insightful business counsel and support,” said Mr. D’Amato. “Meagan, Abid and Sapna have joined other members of the MCN executive team in conducting research and due diligence.”

The final element of the evening program featured a CEO discussion hosted by MCN Managing Partner, Dale Grogan. Mr. Grogan welcomed Mentavi Health CEO Keith Brophy, PhotoniCare CEO Cary Vance and Poppy Flowers CEO Cameron Hardesty. Each of the executives took time to share their experiences leading start-up and early stage companies. They also talked about the importance of the member-investors.

“It’s clear the CEOs value not only the financial commitment of the investors, but the business counsel and wisdom available to them through the MCN organization,” said Mr. Grogan. “These CEOs are leading strong companies that are well on their way to commercial success, and that should provide confidence to everyone associated with MCN that the work we do matters on many levels.”

For Paul D’Amato, this year’s event provided another opportunity to meet and hear from member-investors and entrepreneurs, and acknowledge their importance to MCN.

“2023 has been a slower year in the VC and angel investing sectors, yet our organization has taken intentional steps to strengthen our core operations in a way that will benefit our members and the companies we support,” said Mr. D’Amato. “As we move through the remainder of this year and early 2024, we are well-positioned for success that should deliver positive impacts for everyone involved with MCN.”